Annual financial news and ad hoc releases

In our archive you will find financial news since 2005

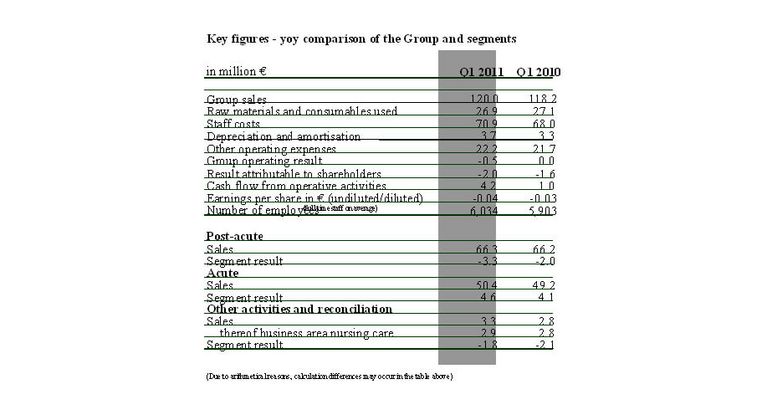

Offenburg, 11 May 2011 –MEDICLIN Aktiengesellschaft (MediClin) achieved Group sales of EUR 120.0 mill. (Q1 2010: EUR 118,2 mill) for the first three months of the FY 2011, thus EUR 1.8 mill or 1.5 % more than in the comparable previous year’s quarter.

Despite increased Group sales the Group’s operating result of EUR –0.5 mill. was EUR 0.5 mill. less than the previous year’s value. Decisive here were primarily higher quarter-on-quarter staff costs (EUR +2.9 mill.).The result attributable to the shareholders of MediClin amounted to EUR–2.0 mill. (Q1 2010: EUR -1.6 mill.).

In the acute segment increased sales could offset higher costs

Sales in the post-acute segment amounted to EUR 66.3 mill., or were EUR 0.1 mill. higher than the previous year’s value. Costs including depreciation and amortisation rose as compared to the same period last year by EUR 1.7 mill., leading to a decreased segment result of EUR –3.3 mill. Sales in the acute segment increased by EUR 1.2 mill. to EUR 50.4 mill. Here the revenues could offset the higher costs, so that the segment result improved from EUR 4.1 mill. to EUR 4.6 mill. In both segments, staff costs are the largest cost item, representing 54.3 % (post-acute) and 51.4 % (acute) of overall costs.

Proposal of a dividend payment

As business development in 2010 was satisfactory, and the Management Board foresee stable economic environment as well as a stable labour market in 2011, the Management Board and the Supervisory Board will propose a dividend of EUR 0.05 per share for the 2010 financial year at the Annual General Meeting on 26 May 2011.

Market development and outlook

In the post-acute segment, the lower indication-based reference values decreed by the German Pension Fund since the end of 2010 for the average length of patient stay and an altered authorisation procedure for certain indications becoming noticeable. There are no signs, however, that there will be lower utilisation of budgets in 2011 on the part of the coverage providers.

In 2011, MediClin will invest in internal growth, and as far as the framework conditions of the industry and the referral behaviour of the coverage providers do not seriously alter in 2011, the Management Board expects a slight increase in turnover as well as an results comparable to the previous year. In terms of external growth, acquisition efforts will be focused on the acute sector.

The interim report Q1 2011 is available under www.mediclin.de in German und English.

About MediClin AG (Ticker: MED; ISIN: DE0006595101)

MediClin AG is a nation-wide clinic operator and large provider of services in the area of Psycho- and Neurosciences as well as Orthopaedic. With 34 clinics and 7 nursing care facilities and 11 Medizinische Versorgungszentren (medical care units) in 11 federal states MediClin has a total capacity of approximately 8,000 beds. MediClins’ facilities include acute care clinics, i.e., general hospitals, special treatment facilities, specialised hospitals and clinics for post-acute treatment and medical rehabilitation. MediClin has approximately 8,200 employees.